Foreign investments in Latvia

About Foreign investments, in brief:

* accumulated foreign direct investments – EUR 9,3 billion EUR;

* accumulated foreign direct investments in share capital of companies in Latvia – EUR 6.1 billion EUR;

* accumulated foreign direct investments per capita: EUR 4 223,10;

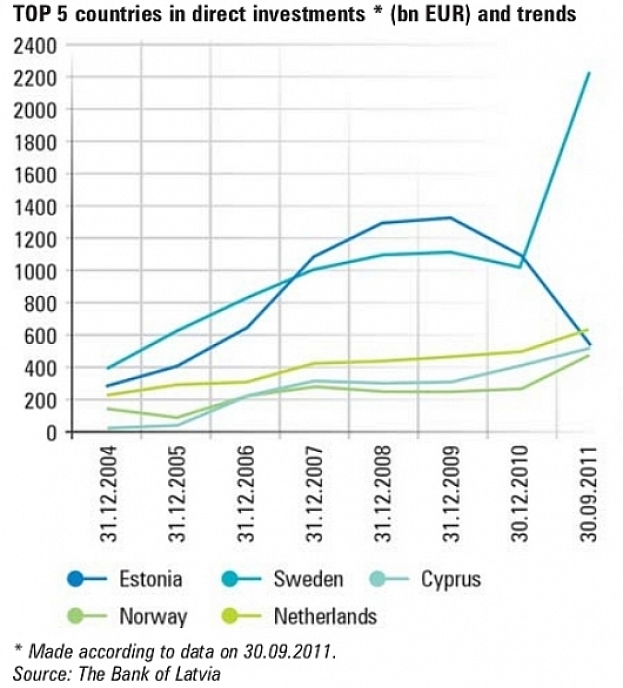

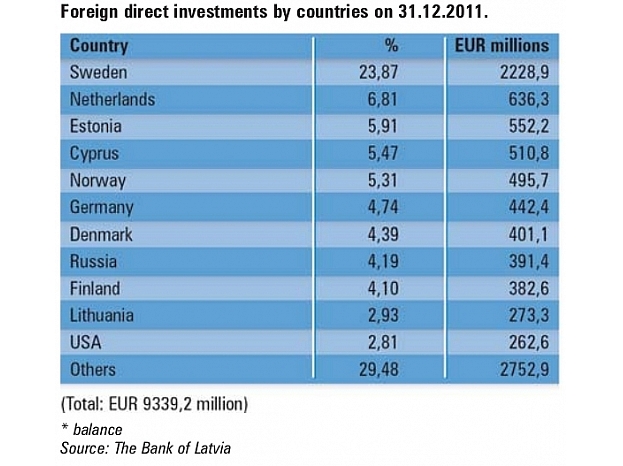

* the countries, which have made the most significant investments: Sweden, the Netherlands, Estonia;

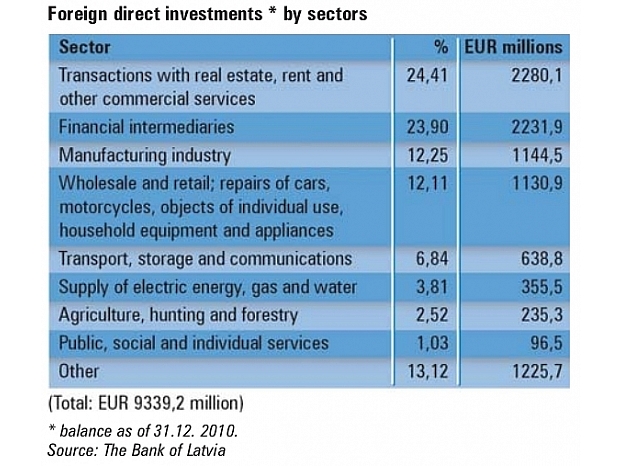

* the largest foreign investments are made in the areas of finance and real estate;

* the largest registered share capital of a foreign investor: Swedbank – EUR 943 million;

* 85% foreign investments are made in Riga and its closest vicinity.

Autors: arvalstu_investiciju_vide_latvija_en_16_1_lv_1_777x615

Legislation promotes investment for Russia

Foreign direct investment in equity, reinvested earnings and other forms of capital has grown rapidly since Latvia regained its independence in 1991 until the rates of growth slowed because of the financial crisis. However, in the first nine months of 2011, the volume of foreign direct investment was almost three times higher than the total foreign direct investments in all of 2010. The lion’s share came from Russia and the CIS, facilitated by changes in the Law on Immigration, which allowed foreign investors to obtain temporary residence permits in Latvia.

* The total balance of foreign direct investments (FDI) comprises 80% of the investments from European countries, but the largest investors are Sweden, Netherlands and Estonia.

* The first foreign direct investments in Latvia were made after independence was regained in 1991. Scandinavian capital poured into telecommunications (Lattelecom) and finance (Hansabank, later renamed as Swedbank). The privatization of several dozen companies between 1993–1995 also facilitated foreign investment. Investments from German and Russia were made by Ruhrgas and Gazprom, respectively, in the privatization of Latvijas gāze. A direct investment from Sweden was made when Skandinaviska Enskilda Banken (SEB) purchased Latvijas Unibanka. The flow of investment from Scandinavia increased in 1998 after the crisis in Russia and, to date, it has taken the leading role ahead of other countries.

* Latvia experienced a new wave of foreign investments (from both new investors and existing foreign companies that developed their activities) after joining the EU in 2004. The increase was seen not only in FDI but also in the resources attracted by banks (loans from parent companies, syndicated credits, deposits made by non-residents), a part of which was used for mortgages for the purchase of real estate. Net FDI increased from EUR 3,3 billion at the end of year 2004 to EUR 8.1 billion at the end of year 2008. Meanwhile, bank lending at the end of 2008 reached EUR 14,3 billion, according to the balance of international investments in Latvia compiled by the Bank of Latvia. During the crisis, the volume of the bank loans fell to EUR 9,4 billion at the end of September 2010, but at the end of 2010, bank borrowing fell to zero, at the same deposits by foreign banks rose to EUR 15,2 billion. At the end of September 2011, the volume of deposits by foreign banks was EUR 13,9 billion.

* The pace of investment increase changed considerably in 2009. In comparison with 2007 when net value of transactions was

EUR 1,7 billion, which was the best result annual result, in 2009 it was only EUR 67,6 million. The situation gradually improved in 2010, there were several transactions of company sales carried out and this trend continues also in 2011. In the first nine months of 2011, the volume of direct foreign investment in the Latvian economy was three times higher than the total volume of foreign in all of 2011.

* As of the end of September, 2011 net FDI in Latvia was EUR 9,34 billion, which is EUR 4 223,1 per capita, according to data from the Bank of Latvia. Compared to the end of 2010, cumulative foreign investment had increased by 14% but compared to 2003, it had grown 3,3 times.

* In geopolitical terms, investments from EU countries comprise most of the cumulative foreign investment in Latvia. In terms of the number of investors, the largest increase was from Russia and the other CIS countries, which was facilitated by changes in the Law on Immigration in 2010, which stipulated that temporary residence permits can be issued to persons who have purchase one or more real estate properties or investment in the equity of a company.

Investments by sector

To date, most foreign investments were made in the financial and real estate sectors, as well as telecommunications. Many investment projects, especially in manufacturing and agriculture, have not been yet implemented in Latvia. There are several reasons for this, including passivity of state institutions, resistance demonstrated by local residents and disputes among existing shareholders. Foreign investors show great interest in investments in Latvia; they are interested in acquisition of assets with a long-term outlook for a low price, as well the purchase of competitors’ companies.

At this moment it is difficult to forecast which sectors will be the most attractive for investment, but the greatest interest is shown in real estate, as well as investment opportunities in food processing, timber processing and printing companies in Latvia.

Autors: arvalstu_investiciju_vide_latvija_en_17_2_en_2_588x507

Investments in share capital of companies in Latvia

* In 2011, there was a sharp increase in the number of investors and the volume of direct investment in the equity of Latvian companies. In 2011, the number of investors increased by 1 886 persons, which is three times more than in 2010. Since 1991, 18 156 foreign investors have invested in Latvian companies. At the end of 2011, cumulative FDI in Latvian companies increased by 8,19% to EUR 6,12 billion.

* Also, the share capital of much FDI is related to sectors that have been heavily affected by the crisis, for example, the banking and real estate sector. In most cases (85%), foreign investments have been made in Riga, the capital of Latvia, and its surrounding area.

* There are 437 companies in Latvia where share capital by of foreign investors exceeds EUR 1,4 million, and their total investment volume reached EUR 5,47 billion in March 2011.

* The single largest foreign investment in equity capital – EUR 943 million, belongs to Swedbank. Previously Swedbank in Estonia directly owned this bank, but since 2011, Sweden’s Swedbank, the actual source of capital, is registered as the owner. Thanks to Swedbank, Estonia was and Sweden is the country with the largest share of foreign investments in Latvia. Behind Swedbank by several orders of magnitude are DnB Banka (EUR 191,2 million) and SEB banka (EUR 145,3 million).

Investment promotion policies

* The government, the Latvian Investment and Development Agency (LIDA), and the Ministry of Economics propose various changes in legislation, including financing foreign visits, to promote the involvement of foreign investors in Latvia. Since 1999, Latvia is a member of the WTO, but in 2004 it joined the EU and NATO. Latvia has concluded bilateral investment promotion and protection agreements with all of its most important partners.

* The business environment is favorable for foreign investments and entrepreneurship: our laws are in line with the legislation of the EU; besides import duties and taxes, there are no additional limitations for the free movement of capital and goods. In transactions with the EU countries, there are no such restrictions at all.

* The government has prepared a draft investment promotion strategy, in accordance with which Latvia’s main goal is to attract investment in export-oriented manufacturing and services sectors. The strategy identifies target sectors for attracting investment – the forestry and wood industries, metalworking and machine-building, transport and logistics, information technology, life sciences, health care and green technologies.

Autors: arvalstu_investiciju_vide_latvija_en_17_1_en_3_582x644

Autors: arvalstu_investiciju_vide_latvija_en_16_2_en_4_578x527

Useful information for investors

* Starting from 1 January 2011, a rebate for Corporate Income Tax (CIT) was reintroduced for the investments made in priority sectors. If the sum of the investment is from EUR 7 to 50 million, a rebate of CIT in the amount of 25% applied, but if the sum of the investment exceeds 50 million EUR, there is 15% rebate applied to the sum in excess.

* If foreign investors purchase real estate in Latvia for a price exceeding EUR 142 000 in Riga, and EUR 71 000 in other regions, or invest in the share capital of a company in the amount of EUR 36 000 (if this company pays taxes of least EUR 28 000 annually), or invest EUR 286 000 in a Latvian credit institutions, it is grounds for issuing a temporary residence permit.

* The LIDA has established and offers foreign companies, which are willing to launch their activities in Latvia, electronic data base of real estate, which contains the information received from local governments, companies and private persons about real estate, which can be used for the development of entrepreneurship, especially for the opening production units.

* The Foreign Investors’ Council in Latvia represents the interests of large foreign investors in Latvia.

Useful links

The Bank of Latvia – www.bank.lv

Latvian Investment and Development Agency – www.liaa.gov.lv

The Foreign Investors’ Council in Latvia – www.ficil.lv

The Ministry of Economics – www.em.gov.lv

The Ministry of Foreign Affairs – www.mfa.gov.lv

Riga Stock Exchange (NASDAQ OMX Riga) – www.nasdaqomxbaltic.com

The Central Statistical Bureau – www.csb.gov.lv

Register of Latvian companies legal and contact data – www.firmas.lv

Photo: Pilseta24.lv