Foreign investments in Estonia

The second coming of Finish investments

In a manner similar to other small-scale open economies, Estonia needs a constant flow of foreign investments in order to maintain the expansion of its economy.

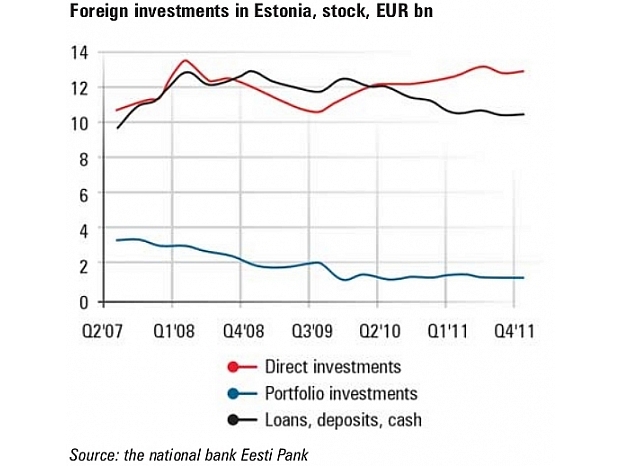

* And indeed, the flow has been constant for the past 15 years, with the only exception being the recession year 2009, when the stock of direct investments declined by 1%. Since 1998, direct foreign investments have increased by almost 20-fold, totalling EUR 12,8bn in the end of 2011.

* In the end of 2011, the volume of FDI grew by 3,7% compared to the end of the previous year. However, at the same time, the stock of portfolio investments declined by 7,2% to EUR 1,3bn, while other investments (loans, trade credits, deposits and other liabilities) decreased by 5,2% to EUR 12,2bn. In overall, Estonia’s external liabilities contracted in 2011 by EUR 328m y-o-y to EUR 26,4bn, mostly due to the Scandinavian banks cutting credit lines of their Estonian branches and subsidiaries.

Investors and business branches

* Direct investments in the industrial sector increased in 2011, mostly due to the Finnish companies either moving their production units to Estonia or investing in additional production capacity of their Estonian subsidiaries. The trend that can be named as the second coming of Finns (the first one was in nineties when low labour costs were Estonia's main attraction), is at least partly due to the adoption of EU's common currency euro on 1 January 2011. By joining the euro-zone Estonia minimized currency-related risks and accounting complexity for foreign investors.

*The NYSE-listed rare earth metals producer Molycorp that took over the Estonian peer Silmet in a USD 89m deal accomplished the largest foreign investment in Estonian industrial sector in the last year. Some of the other companies investing in Estonia in 2011 were the Finnish Muoviura (plastics), Incap (electronics), Nokka (cranes), Vado (industrial filters), Lappset (playgrounds), Kemira (chemicals), but also the Latvian Latvijas Finieris (plywood), the Swedish Hanza (electronics), the US-headquartered Eastman (chemicals) and the Swiss-headquartered ABB (electrical equipment), among many others.

In other sectors, several new investors entered Estonia as well. The Scandinavian shipping company DFDS acquired Paldiski-Kapellskär ferry service in the last year, while Møller purchased a VW dealership and Leonhard Weiss bought a railroad construction company. In the end of 2011 the Finnish Fortum divested some of its Estonian assets, at the same time introducing two new investors: the countrymen Imatran Seudun Sähkö and the Swedish EQT.

*The enlivened investment activity in 2011 did not change the overall picture radically, though. Still, local businessmen largely dominate several sectors, while in some others the foreign investors' presence is overwhelming. For instance, the finance sector is 95% dominated by the Nordic banks Swedbank, SEB, Nordea and Danske Bank, while the telecom market is divided between TeliaSonera, Tele2 and Elisa.

In media, printed and online, the Norwegian Schibsted, the Swedish Bonnier and the Finnish Alma Media have significant shares. Both countrywide commercial TV-channels belong to Schibsted and Viasat; the latter is also the leading satellite broadcaster. Starman, the largest cable-TV provider, was recently acquired in full by a foreign investment funds led by the British Bancroft and de-listed form the Tallinn stock exchange. 49% of Levira, the company operating the terrestrial TV transmitters network, is owned by the French TDF.

Additionally, foreign investors are heavily present in the food industry. Carlsberg, Harboes Bryggeri and Olvi have 95% of beer and light alcoholic drinks market. The Finnish Fazer and Vaasan compete against each other in bread production, while their countrymen Atria and HK Scan have the two top spots in meat production.

In the retail sector, foreign investors own three out of seven supermarket chains, including the largest Lithuanian investment in Estonia, the Maxima chain. The Norwegian Statoil and the Finnish Neste are the largest fuel retailers in Estonia; in fuel wholesale, they only lose to the local subsidiary of the Polish Orlen -owned Mažeikiu Nafta. The largest player in oil products throughput and storage business is the Dutch Vopak.

Autors: arvalstu_investicijas_igaunija_en_19_2_en_4_544x518

TOP investors: Sweden and Finland

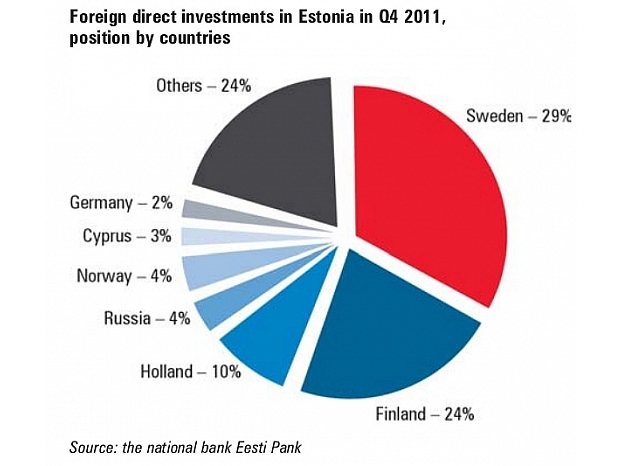

* 28.7% of direct investments in Estonia have been made by Swedish residents, both individuals and corporate entities, amounting to EUR 3.7bn in the end of the 4th quarter of 2011, according to the statistics of the national bank Eesti Pank. The share of Swedes in the stock of direct investments has declined by EUR 646m in yearly comparison in 2011, mostly due to one transaction: Swedbank transferring its Latvian and Lithuanian subsidiaries, which so far were under the Estonian unit, to the direct jurisdiction of Stockholm headquarters, correspondingly cutting the share capital of Estonian Swedbank.

* The next top countries investing in Estonia in the end of 2011 were Finland (increase by 5.6% y-o-y in 2011 to EUR 3bn, 23.8% total share), Holland (+20.9% y-o-y to EUR 1.3bn, 10.4%) and Russia (+22% y-o-y to EUR 0.52bn, 4%). US and Swiss -registered entities and individuals increased their direct investments the most – by 62% in annual comparison.

* Estonian direct investments abroad decreased by 16.5% y-o-y to EUR 3.6bn in 2011, largely due to the above-mentioned transaction by Swedbank. Accordingly, Estonian investments to Latvia decreased by 36.2% to EUR 0.7bn and those to Lithuania by 41% to 0.76bn. Still, both neighbours lead the list of investee countries ahead of Cyprus, Finland, Russia and Ukraine.

* Direct investments made by residents of the European Union countries comprise 83.3% of the total stock of direct investments, while 79.4% of Estonian funds abroadwere invested in member countries of the EU by the end of 2011.

Estonian net international investment position has been in the red since regaining independence, due to the reason mentioned above: the country's economy is small, open and constantly hungry for capital inflow. During the recent years, however, the imbalance has declined. In the end of 2011, Estonia's net international investment position stood at EUR -9.2bn, an improvement by EUR 3.2bn since 2008.

Estonia's net external debt has declined in recent years as well, from EUR 6.14bn in 2008 to EUR 1.13bn in 2011. While in short-term, analysts consider the improvement in Estonia's external debt position a positive sign, reaching and maintaining surplus may begin to hamper the country's further economic growth.

Autors: arvalstu_investicijas_igaunija_en_19_1_en_2_609x533

Photo: Stock.XCHNG