Tax System of Latvia

Government promises a more stable tax system

About tax system, in brief:

* in 2011 the tax burden (tax income against GDP) reached 28,1% of GDP in Latvia, which is one of the lowest indicators in EU;

* there are 13 taxes and 97 state fees in force in Latvia;

* an electronic declaration system is used from 1 January 2011;

* the government is considering lowering taxes on labor in 2013.

Autors: latvijas_nodoklu_sistema_en_tax_1_1229x551

The tax system of Latvia is not the simplest one, however, it cannot be considered as very complicated in comparison to the old EU Member States. Problems hitherto have been created by protracted changeability in the tax system, which the government has promised not to allow in the.

* At the end of 2011, the government adopted a Tax Policy Strategy for 2011–2014, where it undertook not to increase the tax burden nor introduce new taxes, as well as to have planned changes in taxes no more than twice a year. It is also promised that during 2012, proposals will be drafted for using tax policy to help municipalities create a more attractive business environment.

* Although tax burden in Latvia is one of the lowest in EU and tax-to-GDP ratio is a little below 30% of GDP, when comparing minimum personal income tax rates the burden of these is one of the highest in EU. Presently, the tax burden on labor, compared to neighboring countries, is the highest, which is why the government has undertaken to reduce taxes on labor from 2013.

* It should be taken into account that there is a large proportion of "hidden economy" in Latvia, the growth of which has been affected by the global financial crisis and also by recent tax changes. Mostly it applies to trade, construction, forestry and the sector of services. The government has set the fight with non-payment of taxes as one of the most important priorities in this year.

* At the end of 2011, the Law on the Declaration of the Property and Undeclared Income of Private Persons came into force.

A declaration of property will have to be filed starting March 1, 2012 by all Latvian citizens, non-citizens and other physical persons who have been issued permanent residence permits. The declaration most applies to persons whose property exceeds a value of LVL 10 000 (EUR 14 229)

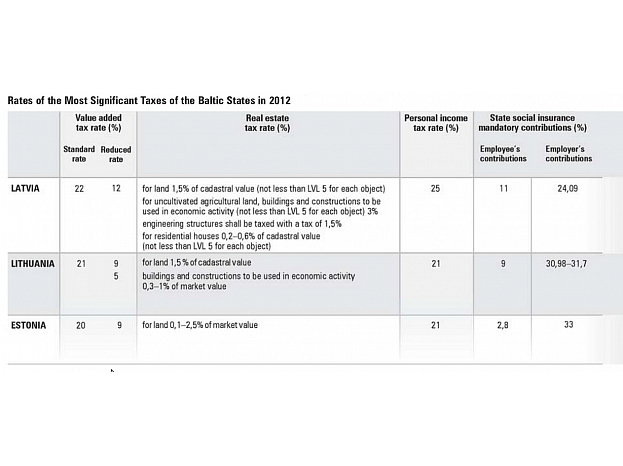

Most Significant Taxes and Standard Rates Thereof:

* Social tax (the State social insurance mandatory contributions): 35,09%

* Personal income tax: 25%

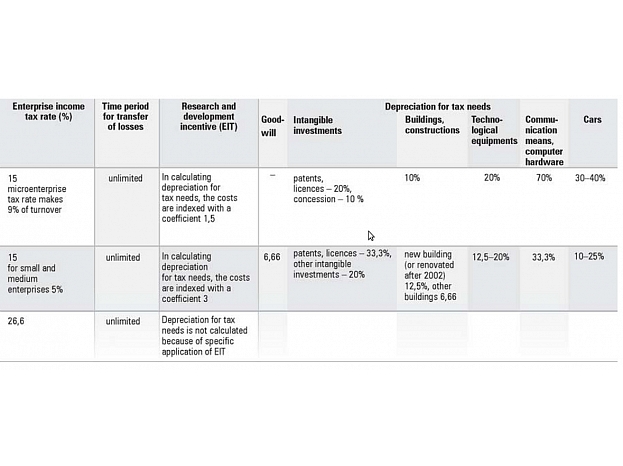

* Corporate income tax: 15%

* Microenterprise tax: 9%

* Payments from income on capital: 10–15%

* Value added tax: 22% (reduced rate 12%), since 1st of July, 2012: 21%

* Excise duty (for tobacco, alcoholic beverages, natural gas, oil products, non-alcoholic beverages, coffee)

* Real estate tax: 0,2–3%

Autors: latvijas_nodoklu_sistema_en_tax_2_1179x522

Taxes on Labor

* The mandatory social insurance contribution is 11% from the employee and 24,09% from the employer.

* The personal income tax rate is 25%. The personal exemption which is not subject to this tax – is EUR 64 per month for the taxpayer himself or herself, and for each dependent person – EUR 100 euro per month. In 2012 lottery and gambling winnings are excluded from income tax.

Parliament passed amendments to Law on Personal Income Tax (PIT), which requires three years to reduce the personal income tax rate by five percentage points - from the existing 25% to 20%. From 1st January, 2013 personal income tax rate will be 24%, in 2014 - 22%, but in 2015 - 20%.

* Fee for entrepreneurship risk shall be related to expenses of workforce the amount of which is EUR 0,36 per month for each employee.

* Income from employment is not taxable if earning in another EU or European Economic Area (EEA) country, or in a country with which Latvia has a treaty on double taxation and the prevention of tax evasion.

Corporate Income Tax

Corporate income tax in Latvia is one of the lowest in EU – 15% that presently is one of cornerstones for attracting investments. It is also facilitated by different corporate income tax credits.

* In 2011, Latvia reinstated the corporate tax credit for large investment projects of EUR 4,3 million or more, which government has accepted by December 31, 2013 and which will be completed by December 31, 2018. To be sure, this special support will be available to a limited range of sectors: production of food and beverages, manufacturing of wood products, production of chemicals and pharmaceuticals, production of metals and metal products, production of computers, electrical and optical equipment, telecommunications, software, logistics and transport support services.

* From January 1, 2013, corporate income tax will not be assessed on dividends paid to non-resident corporations and on dividends received from non-residents. Starting from January 1, 2014, corporate income tax will not be assessed on interest paid to non-residents and on payments for the use of intellectual property. This rule will not apply to payments from low tax countries or countries charging no tax.

* Losses to taxpayers that have occurred starting in 2008 can be deducted for an indefinite time from taxable income in subsequent tax years.

Taxes on Small Enterprises

From 2011 Latvia has introduced a tax of 9% – for small enterprises the turnover of which does not exceed EUR 100 000 (LVL 70 000) per year and which employ up to 5 employees.

Taxes on capital

Since 1 January 2010 income from capital of individuals is taxable with personal income tax in Latvia, however these rates are lower than the standard rate. From 2012, investments in gold and precious methods are considered capital assets, as well as assets traded on foreign exchange or commodity exchanges.

Personal income tax rates for income from capital (%)

For dividends 10

Interest income (including interest of deposits) 10

Income from investments 10

Income from life insurance (with accumulation of means) 10

Income from sale of real iestate (if the property is in ownership for less than 60 months and it is a declared place of residence for a year) 15

Income from sale of capital shares 15

Income from sale of securities (except income from EU and EFTA member states and self-government bonds) 15

Value Added Tax

Standard VAT rate currently is 22%, the reduced VAT rate is 12%. From 1st of July, 2012, the standard VAT rate is reduced by one percentage point and decrease to 21%.

Real estate Tax

The real estate tax rate for land is 1,5% of cadastral value and it is the same for civil engineering structures. The rate for homes is 0,2%–0,6% depending on value. The government plans to gradually implement tax reforms in 2012 and 2013, expanding the rights of municipalities to make decisions about real estate tax in their territory.

Excise Duty

Excise duty on the subject of alcoholic beverages, tobacco products, petroleum products, natural gas, non-alcoholic beverages and coffee. In 2011, the excise tax rate was increased on several products subject to excise tax. The Tax Policy Strategy for 2011–2014 expresses

a commitment not to increase the rate on petroleum products and alcoholic beverages, but on tobacco products, to gradually increase the rate no earlier than 2014 until it reaches the minimum EU level in 2018.

Natural Resources Tax

Natural resources tax shall be paid by enterprises and private persons if they acquire taxable natural resources in Latvia (or on a continental shelf), release taxable pollution into the environment, produce goods/products harmful for the environment or sell goods or products harmful for the environment and produced domestically, goods or products in packaging. The tax shall be paid for:

* any natural resources obtained as a result of economic activity;

* environmental pollution – waste, emissions and polluting substances;

* goods and products harmful for the environment; and

* packaging of goods and products imported or produced domestically.

Natural resources tax is differentiated and depends on the type of natural resources and on the type of waste, as well as the threat to the environment. Rates fluctuate from a few santims up to hundred lats.

Other taxes and fees

* A fee for credit institutions – financial stability fee of 0,036% per year of the total amount of commitments is introduced for the first time in Latvia from which deposits, issued mortgage pledge bonds and subordinated commitments are deducted.

* From 2011 there is a new law on vehicle operating tax and company car tax. Now the vehicle operating tax for a motorcar shall be calculated by summing up the tax rates in compliance with full weight of a motorcar, engine capacity and maximum engine power. From 2011 the company car tax is imposed on all motor vehicles owned or held by enterprises, assuming that they are used for private use of employees. An enterprise shall not pay such tax, if it can prove that the car is not used for private needs. A company car tax is from EUR 27 up to EUR 60 (per month) depending on engine capacity.

Useful links

The Ministry of Finance of the Republic of Latvia – www.fm.gov.lv

The State Revenue Service – www.vid.gov.lv

The Latvian Association of Accounting Outsourcing – www.latgraasa.lv

The Accountants Association of the Republic of Latvia – www.lrga.lv

Latvian Association of Certified Auditors – www.lzra.lv

Photo: Pilseta24.lv