Forest industry faces new challenges

Photo: Pilseta24.lv

Forest industry in brief:

• There are three million hectares of forestland in Latvia, covering 52% of the country’s territory;

• The average price for a hectare of forestland ranged from LVL 1500-2000 in 2008 to LVL 800 at the end of 2012;

• There are 155 000 owners of private forests in Latvia;

• 54 000 persons were employed in the forest industry in 2011, a 4% increase on 2010;

• The forestry industry’s share in the value-added structure of GDP amounted to 6,8% in 2011 and 5% in 2012;

• The government has listed the timber industry among priority industries.

• The forest industry was the second most profitable industry in Latvia’s economy in 2011, straight after the energy industry, earning LVL 160,8 million. The timber industry is the driving force behind it. The manufacturing of sawn coniferous products is particularly well-developed. The manufacturing of birch plywood and its products plays an important part as well. Latvia is among Eastern Europe’s largest manufacturers of birch plywood.

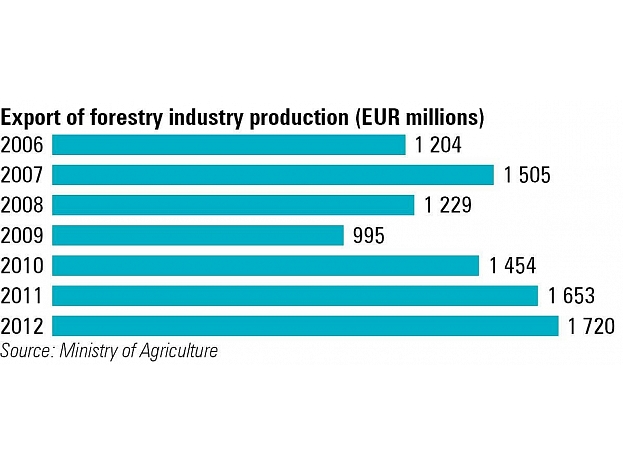

• Forest industry export constituted 18,1% in 2011, when the forest industry was Latvia’s most important export industry. The forest industry maintained its leading position also in 2012. Compared to the corresponding period in 2011, forest industry export grew 5,1% in the first eleven months of 2012, reaching LVL 1,131 billion. Export income per hectare amounts to around LVL 300 each year. Timber production reached 12,73 million cubic metres last year.

• Timber and timber product export amounted to LVL 976,167 million, 4,7% more than in the first eleven months of 2011. Sawn timber and round timber constituted the largest share in the industry’s export value – LVL 284,151 million and LVL 116,123 million, respectively.

Largest markets – Sweden, Great Britain and Germany

• Sweden, Great Britain and Germany were the largest forest industry export markets in 2012. LVL 146,293 million worth of forest industry production was exported to Sweden in the first eleven months of 2012, 12,9% of the industry’s exports. LVL 135,959 million worth of production (12%) was exported to Great Britain, LVL 130,215 million (11,5%) – to Germany.

• Forest industry import reached LVL 322,956 million in the first eleven months of 2012, 11,7% more than in the respective period in 2011, when the figure stood at LVL 289,170 million.

Timber purchase prices stabilize

• Compared to the same period in 2011, the average purchase prices of coniferous round timber fluctuated LVL 1-2 per cubic meter in the first half of 2012. The purchase prices of packaging blocks decreased 5%, of thick birch saw logs – increased 9%. The average purchase prices of thin aspen tree saw logs reduced LVL 2,5 per cubic metre. The purchase prices of thick black alder saw logs grew 5% due to the hard-to-predict situation on local and European markets, making companies operate in the conditions of a fluctuating market.

• Regional competition among manufacturers is one of the most important factors affecting the price.

Autors: forest_industry_faces_new_challenges_en_koki1_1197x511

* Average number of employees. Source: Firmas.lv

Most important industry developments:

1. Overall, past two years will go down in history as successful export years, with the forest industry reaching the highest figures since the restoration of Latvia’s independence. These accomplishments are mostly based on the actions of forest industry professionals at the start of the 2008 crisis, when they carried out several measures, improving efficiency and productivity. Moreover, investments in new technologies have not stopped and it is expected that the global competitiveness of forest industry companies will continue to grow.

2. As of September 2, 2012, pine and fir tree round timber import from Russia is subject to reduced tariffs. Russia’s export tariff on fir tree round timber is set at 13%, pine tree round timber – 15% (previously 25%, but no less than EUR 15 (LVL 10,5) per cubic metre). Due to Russia’s accession to the World Trade Organisation, the country’s import tariff on timber industry products has been reduced from 15,4% to 8,6% as of August 22.

3. The lack of qualified labour force at wood-processing companies remains the industry’s main problem. Over the past few years, the manufacturing process has been automated to the maximum and manufacturing is no longer possible by employing low status labourers.

4. Regarding the wood-processing industry’s future prospects, much attention will be paid to further process timber and manufacture products with a higher added value. This will be possible due to the achieved level of sawn timber and slabs, which corresponds the highest international standards. During further development, the process will not be replaced, but supplemented by further processing sawn timber.

Forest industry’s largest companies in terms of net turnover in 2011

|

Company

|

Specialisation

|

Turnover 2011, millions, EUR

|

Turnover 2010, millions, EUR

|

Turnover changes 2011 vs 2010, %

|

Profit 2011, millions, EUR

|

Number of employees, 2011*

|

|

JSC Latvijas valsts meži

|

Forest management

|

305,52

|

307,29

|

-0,57%

|

72,52

|

1 137

|

|

LSC Latvijas Finieris

|

Wood-processing

|

168,68

|

138,71

|

21,60%

|

13,58

|

1 532

|

|

Bolderaja Ltd

|

Wood-processing

|

127,90

|

118,96

|

7,51%

|

30,75

|

280

|

|

Pata AB Ltd

|

Wood sales

|

99,82

|

90,02

|

10%

|

4,51

|

152

|

|

JSC Stora Enso Latvia

|

Wood sales

|

80,07

|

70,75

|

13%

|

3,58

|

144

|

* Average number of employees. Source: Firmas.lv

Useful links

Ministry of Agriculture

Central Statistical Bureau

Agricultural Market Promotion Centre

Agricultural Data Centre

Rural Support Service